The book by Tom Eisenmann

One of my favorite authors on business strategy, Tomas Eisenmann, has researched the failure of startups and wrote the book, “Why Startups Fail”.

In this book he describes six patterns that account for the majority of startup failures:

- Bad bedfellows. Startup success is thought to rest largely on the founder’s talents and instincts. But the wrong team, investors, or partners can sink a venture just as quickly.

- False starts. In following the oft-cited advice to “fail fast” and to “launch before you’re ready”, founders risk wasting time and capital on the wrong solutions.

- False promises. Success with early adopters can be misleading and give founders unwarranted confidence to expand.

- Speed traps. Despite the pressure to “get big fast”, hypergrowth can spell disaster for even the most promising ventures.

- Help wanted. Rapidly scaling startups need lots of capital and talent, but they can make mistakes that leave them suddenly in short supply of both.

- Cascading miracles. Silicon Valley exhorts entrepreneurs to dream big. But the bigger the vision, the more things that can go wrong.

Eisenmann’s “Letter to a First-Time Founder” is a good summary, but reading the book itself is worth your time. I can recommend the book to everyone who is involved in a startup that appears to be doing well. It could be a depressing read when you are in a startup that is failing. I found it reassuring.

The book uses examples of failed startups to illustrate the six patterns. But it is not just a collection of case studies. The appendix contains survey data on 470 startups (successful as well as failed startups).

Is Intellectual Property important for Startups?

Intellectual Property is not discussed in the book. The survey has one question about IPR: “How important was proprietary intellectual property for your startup?”

Of the startups with high valuation (startups that returned more than 150% to the early investors) 28% responded that “Proprietary Intellectual Property” was “extremely important”.

The 28% is low! Much lower than I would have expected. It suggests that the vast majority of startups have difficulty preventing others from copying their products or service and that they rely primarily on first-to-market advantage, cost advantage by getting to volume faster, and switching costs.

The response of the startups with low valuation (includes failed startups) makes sense. Only 8% responded that proprietary intellectual property was “extremely important”.

The startups used as example in the book did not use proprietary intellectual property as a way to gain a competitive advantage. They are mostly based on a proposition for a better consumer product or consumer service. That made them reliant on superior execution of product development, manufacturing, and logistics.

IPR Licensing as business model

None of the startups discussed in the book targeted IPR licensing as main source of income. I wonder if the failure rate, and reasons for failure, are different for such startups. Startups that don’t sell products but only sell licenses avoid the investments that come with mass-market manufacturing and consumer marketing and customer acquisition. That makes it easier for them to survive. On the other hand, selling technology licenses is hard. An unproven technology coming from a small startup will need to promise vastly superior properties before potential customers will even start evaluating the technology in a proof of concept study. A technology licensing startup can easily end in limbo when potential customers keep evaluating the technology without using it in their products.

By setting the right the terms and conditions for intellectual property licensing, startups create optimal conditions for the adoption of their technology. The right IPR policy and license program is key to the success of startups that have created technology that can be used more broadly than in their own products.

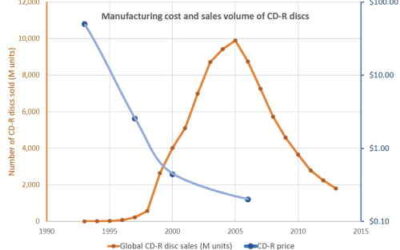

But technology licensing is not easy. The article “Dreaming of Power Through the Air” has a list of startups that tried to market technologies that deliver power through the air. They almost all failed or have yet to deliver value to investors. Energous, for example, has been around since 2012 and has yet to generate a positive cashflow. That’s a startup in limbo.

Other publications by Eisenmann

I used Eisenmann’s 2008 paper on “Managing Proprietary and Shared Platforms” in my analysis of a standards battle between the Wireless Power Consortium and Powermat.